We thought we would use the blog this month to put together a post outlining some useful information and the answers to questions which we often get asked.

Storage Locations

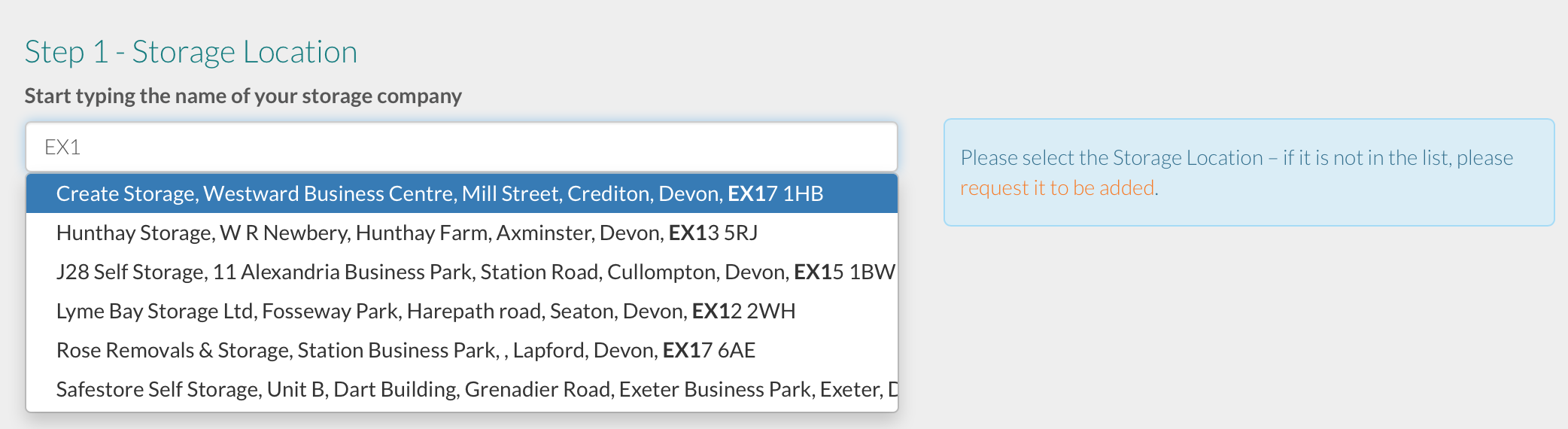

The first step when getting a quote for our Storage Insurance Product is to find your storage location...

We find it is often easier to search by postcode initially (storage names do not always give an accurate result).If you add the postcode of the storage facility you should find that any matching locations we already have in our storage location database will be listed and you can select your location.

*Our Tip– make sure you scroll down to see all the storage locations listed as the box is a fixed size*

If we are unable to find your location, you can request an addition by clicking on the link in the form or by navigating tohttps://www.store-insure.co.uk/add-a-storage-locationand follow the instruction on the form.We need to ensure that your storage location meets our criteria for insurance.We will send you an email to confirm once we have added your location and you will then be able to proceed with your quote and cover.

What storage locations are suitable?

We are sometimes asked if it is possible to insure goods which are in storage in a container or outbuilding at home.

We do not offer a storage insurance policy which would cover these items as a stand alone policy.The likelihood is however, that your home insurance would cover items which you are storing at home, even if they are in an outbuilding, shed or container.It would be worth looking carefully at your existing policy however, to make sure that you understand the limits to the value of contents stored in these areas.

Analysis of 359 home contents policies undertaken by Go-Compare in 2015 saw that the limit on policy cover for goods stored in sheds and outbuildings ranged from £500 to unlimited (with the majority being between £1000 and £3000).Although, 3% of insurers did not cover anything so this is definitely something which you need to look at carefully.

*Our Tip– make sure that you think carefully about the value of any items which are stored in outbuildings, sheds or other external storage areas.It is surprising how much some of the items which are typically stored in these areas can add up to. Make a list and think about the cost of replacement of these items to make sure your existing policy cover is adequate for your needs. If you find that the value of items you are storing is more than you were expecting, it may be worth considering using a dedicated self storage unit instead, where your items are likely to be much more secure.

Valuables and Single Item Limit

Another question we are often asked is what constitutes a valuable and what is a single item limit?Obviously, valuable is a highly subjective term so for the avoidance of doubt, the definition of a valuable, in relation to our storage insurance policy, is as follows:

Valuables are defined as;

Jewellery, watches, furs, items or sets or collections of gold, silver or other precious metals, works of art, sets of stamps, coins or medals all belonging to you.

But not:

Property more specifically insured by any other policy.

Property held or used for any profession, Business or employment.

The maximum amount insured forValuablesis 10% ofYoursum insured or £5,000, whichever is the least.

What is a Single Item limit?

This is the maximum sum which we will pay out under a policy for loss or damage to a single item.The wording in our policy document regarding claim limits for individual items is as follows:

- the individual item sum insured for any one item;

- the single article limit for any one item is £10,000 unlessYour Scheduleshows otherwise.

- 10% ofYour Contentssum insured or £5,000 in respect ofValuablesunlessYour Scheduleshows otherwise;

- £500 for any oneValuableorPedal CycleunlessYour Scheduleshows otherwise;

*Our Tip- cover should be taken out for the full replacement value of all the items which are included and as such, do make sure that you are aware of the limits above.

If you have items which you wish to include above these limits, please get in touch with us so that we can advise you on how best to proceed.