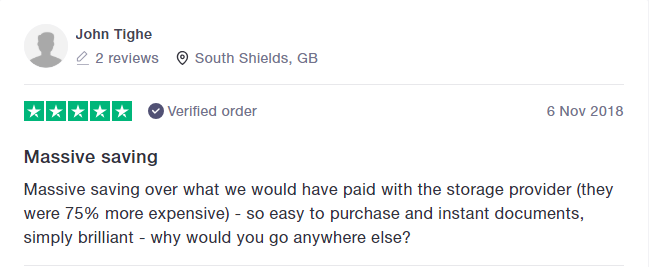

At Store-Insure, we specialise in storage insurance and that's it. Because we are specialist brokers our focus is on a single product, we are able to constantly review our offer to make sure it continues to meet the needs of our customers. Alongside offering one of the most comprehensive storage insurance policies at a very competitive price, we also strive to offer great customer service. Again, as specialist brokers, we offer a level of expertise which you won't always find with a company offering a more diverse product range. Our recent reviews are a testament to this:

As the reviewers above mentioned, it is a criteria in many storage facilities that customers are required to provide proof of insurance before they are able to take up storage. Some people may think that this is a convenient way of storage providers encouraging storage users to take up the facility's own insurance offer - we'll let you make up your own mind on that one!

We have often talked about this in our blog and our advice has always been the same. Shopping around for cover when you are storing goods is the best way to make sure you are getting a good deal and an appropriate level of cover which meets your specific needs.

Because of the need to prove cover, one of the questions we get asked a lot is about confirmation of cover.

When you take up insurance through Store-Insure, you will receive an immediate certificate of cover, along with your policy documents, which can be used as proof of your insurance.

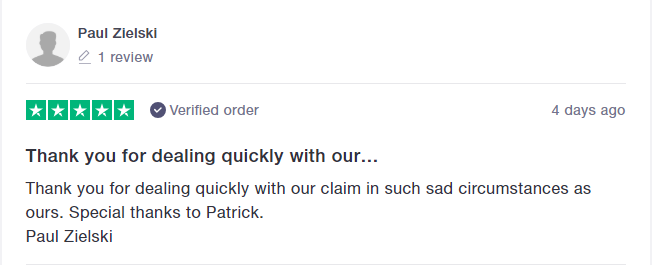

Our recent blog, 'I lost £180,000 in a self storage fire' which covered the effect of a serious fire at a storage facility, highlights the dangers of settling for what is offered as 'inclusive' in the cost of storage, this is especially true in terms of the level of cover provided. A number of people with goods stored at the site have been left with insufficient cover to replace their goods. We did have a number of live policies at the storage unit, all of whom had sufficient cover. Another recent review below is from a customer who needed to claim following the fire:

Of course, when you take out insurance for anything, you hope not to have to test the claims process. However, if you do need to make a claim, we want to make sure that our claim process does not make a stressful time more stressful. With zero excess to pay on standard policies, it's also nice to know you are not going to be out of pocket!